Figure:

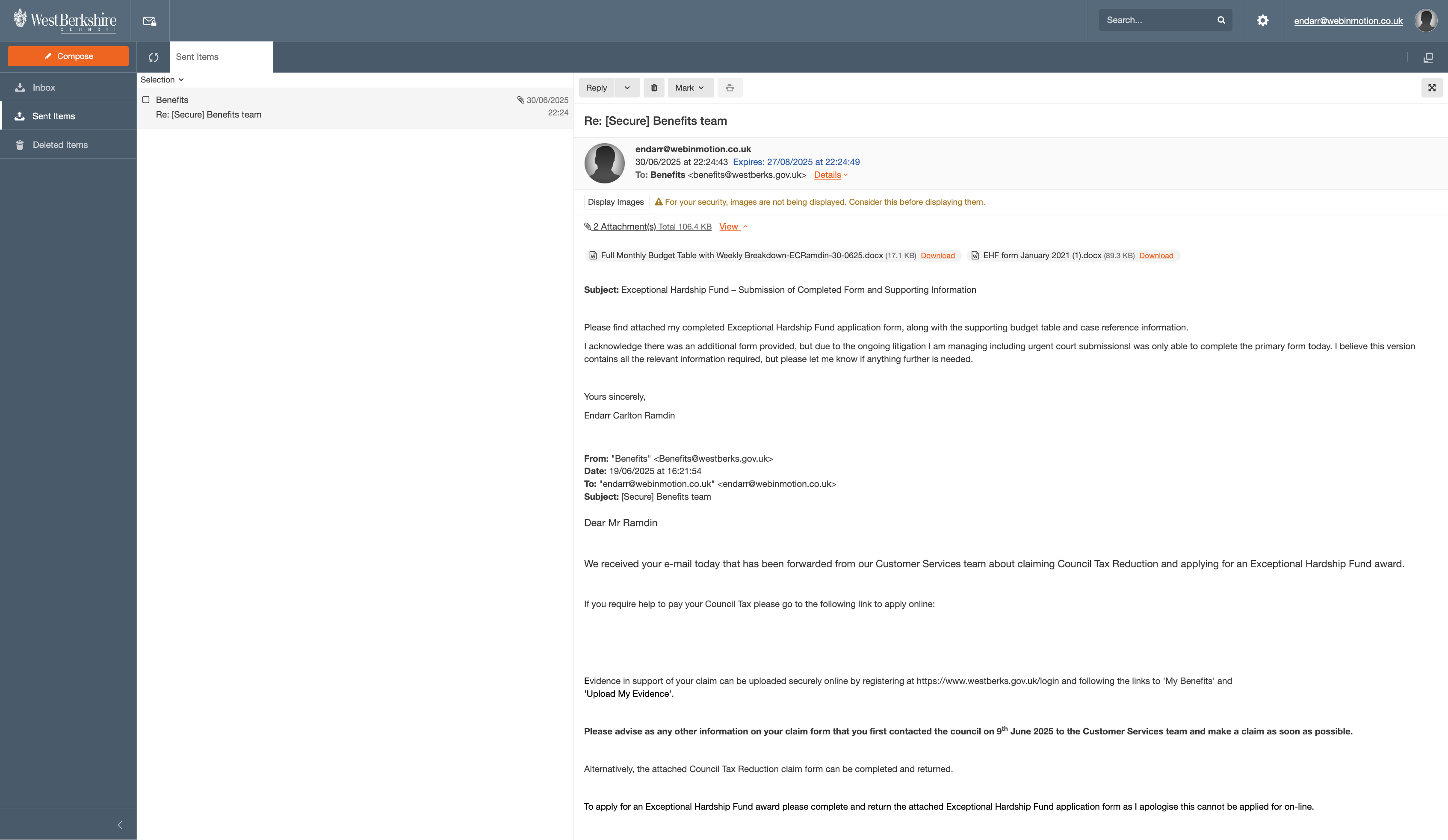

Screenshot of the claimant’s secure West Berkshire Council email submission (30 June 2025), showing the Exceptional Hardship Fund form and supporting documents sent to the Benefits Team.

While British Gas correctly suspended recovery action after receiving documentary proof of vulnerability, West Berkshire Council advanced toward criminal proceedings for alleged council-tax non-payment, despite full compliance, lawful disclosure, and ongoing hardship assessment.

This divergence illustrates how identical information can produce opposite institutional responses one ethical, one retaliatory.

Chronology

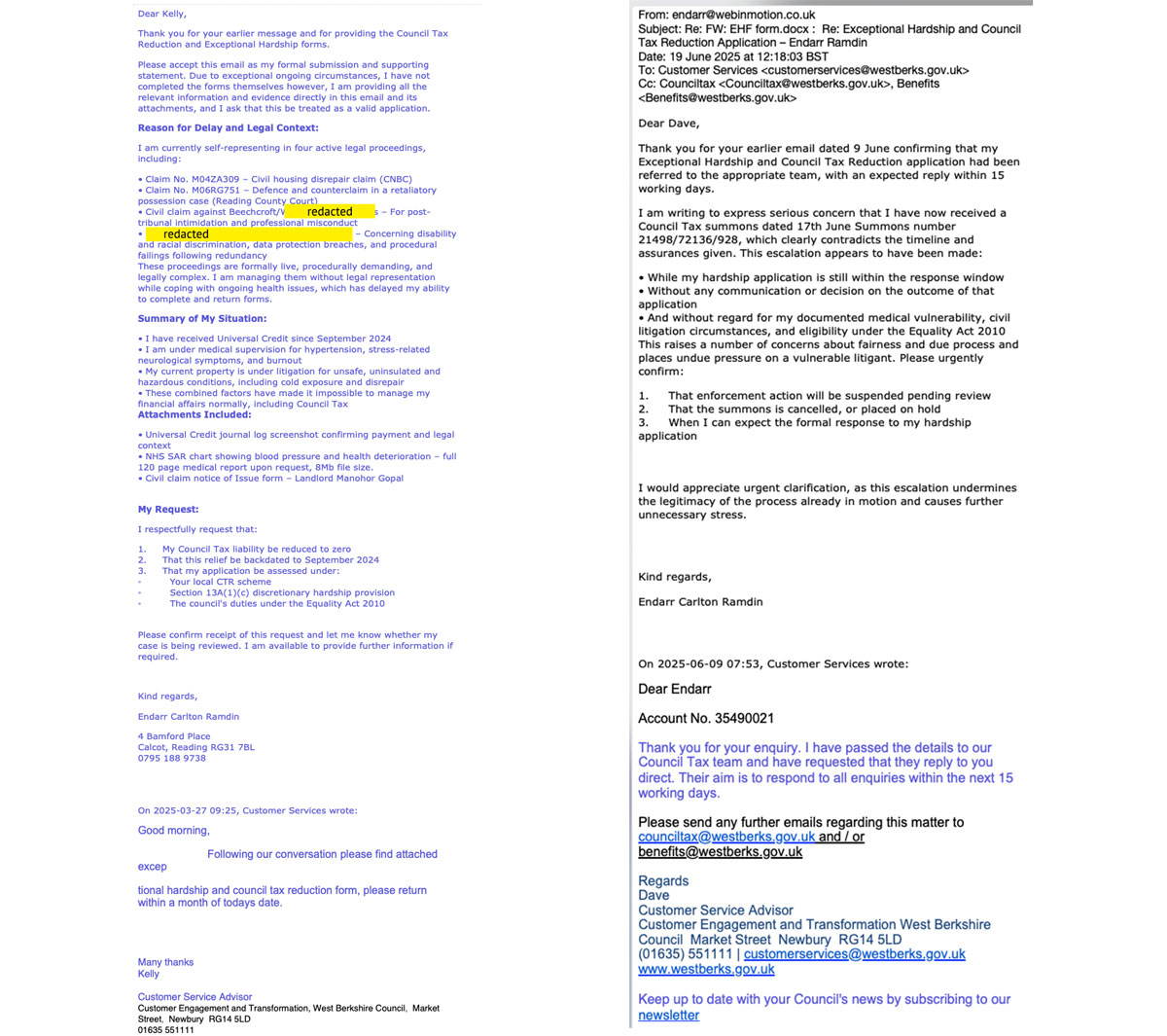

June 2025: Claimant submitted the completed Exceptional Hardship Fund (EHF) form and full budget statement by email to benefits@westberks.gov.uk with timestamped attachments.

July 2025: No acknowledgment was issued. Instead, enforcement warnings were generated, citing “failure to supply information” a provably false representation.

August 2025: Council correspondence implied potential fraud investigation. The claimant, meanwhile, produced a visual timeline (Exhibit WA3) and gas-safety evidence proving procedural compliance and truthful disclosure.

Parallel Event: In identical circumstances, British Gas confirmed receipt of the same disclosure (Ref R0326179) and immediately paused enforcement, recognising vulnerability, active litigation, and documented disrepair (see “Dear British Gas” letter of record).

Pattern of Administrative Fraud

The Council’s conduct satisfies the definitional elements of Fraud Act 2006 s.2 (False Representation) — knowingly or recklessly representing a compliant claimant as non-compliant to gain financial or procedural advantage.

It also constitutes maladministration under Ombudsman standards by:

- failing to record or acknowledge lawful submissions,

- generating false arrears, and

- weaponising data to justify escalation.

Figure: Email thread between the claimant and West Berkshire Council (Customer Services and Benefits Team), evidencing submission of hardship information, medical vulnerability, active litigation context, and requests for lawful suspension of enforcement.

Legal Basis

I. Local Government Finance Act 1992 — Section 13A(1)(c)

“A billing authority may reduce the amount of council tax payable by a person to such extent as it thinks fit… and that power includes power to reduce the amount to nil.”

This provision creates an express statutory discretion that must be exercised lawfully, rationally, and with full consideration of hardship, vulnerability, and individual circumstances before enforcement is pursued.

Legal Duty

A billing authority is required to:

- consider applications for reduction;

- assess financial hardship and vulnerability;

- exercise discretion properly before issuing a summons, liability order, or escalating to criminal enforcement.

Breach Identified

An Exceptional Hardship Fund form was submitted with full financial disclosure, budget analysis, and supporting evidence. The authority failed to acknowledge the submission, did not consider hardship, and proceeded directly to enforcement and threats of criminal proceedings without performing the mandatory s.13A(1)(c) assessment.

This constitutes a breach of public-law fairness and a failure to exercise statutory discretion.

II. Council Tax (Administration and Enforcement) Regulations 1992 — Regulations 34–36

Regulation 34(1):

“Where any amount of council tax is unpaid, the billing authority may apply to a magistrates’ court for a liability order.”

Regulation 34(2):

A “summons stating the amount due and the complaint… shall be served” before an application is made.

Regulation 36(1):

“The court shall make the order if it is satisfied that the sum has become payable and remains unpaid.”

Legal Duty

Before a liability order can be sought, the authority must:

- issue correct and lawful billing;

- serve a valid summons;

- ensure the amount claimed is accurate and legally due;

- adhere strictly to the procedural fairness requirements of Regulations 34–36.

Breach Identified

The authority generated incorrect arrears, asserted fabricated “non-submission of information,” disregarded a pending hardship application, and issued enforcement threats while the account remained in legitimate dispute.

The statutory preconditions under Regulations 34–36 were not satisfied, rendering the liability pathway unlawfully triggered.

III. Fraud Act 2006 — Section 2 (Fraud by False Representation)

A person is guilty of fraud if they:

“(a) dishonestly make a false representation,

(b) intend, by making the representation—

(i) to make a gain for himself or another, or

(ii) to cause loss to another or to expose another to a risk of loss.”

Legal Duty

Public authorities must not create false information, misstate compliance, or construct inaccurate records for the purpose of enforcement.

Breach Identified

The authority asserted “failure to provide information” despite timestamped evidence showing that the documents had been submitted. This misrepresentation was then used to escalate recovery, fees, and criminal implications.

The conduct meets all statutory limbs of s.2: false representation, dishonesty, and exposure to financial or procedural loss.

IV. Equality Act 2010 — Sections 20–21 and Section 149 (Public Sector Equality Duty)

Section 20 — Duty to Make Reasonable Adjustments:

Where a provision, criterion or practice places a disabled person at a substantial disadvantage, the authority “must take such steps as it is reasonable to have to take to avoid the disadvantage.”

Section 21:

A failure to comply with this duty “is a breach of the Act.”

Section 149 — Public Sector Equality Duty (PSED):

Public authorities must have due regard to:

(a) eliminating discrimination;

(b) advancing equality of opportunity;

(c) fostering good relations.

Legal Duty

Authorities must recognise disability and vulnerability when notified, adjust enforcement practice accordingly, and explicitly take equality considerations into account before acting.

Breach Identified

Declared disability, medical vulnerability, litigation-related stress, and severe financial hardship were all notified. A comparable service provider (British Gas) immediately applied vulnerability safeguards, but the authority escalated enforcement without adjustment.

This constitutes a breach of Sections 20–21 and the PSED.

V. Human Rights Act 1998 — Articles 6 and 8 ECHR

Article 6 — Right to a Fair Hearing:

“Everyone is entitled to a fair and public hearing… in the determination of his civil rights and obligations.”

Article 8 — Right to Respect for Private and Family Life:

“There shall be no interference… except such as is in accordance with the law and is necessary…”

Legal Duty

Enforcement activity must be lawful, fair, proportionate, and procedurally sound.

Breach Identified

Enforcement was initiated on the basis of inaccurate data, key evidence was ignored, and escalating actions created a direct interference with private life and personal autonomy. The authority’s actions failed the tests of lawfulness, proportionality, and necessity under Articles 6 and 8.

VI. Data Protection Act 2018 / UK GDPR — Article 5(1)(a) and 5(1)(d)

Article 5(1)(a):

Personal data must be processed “lawfully, fairly and in a transparent manner.”

Article 5(1)(d):

Data must be “accurate” and kept up to date, and controllers must take “every reasonable step” to rectify inaccuracies.

Legal Duty

Authorities must maintain accurate records, correct errors promptly once notified, and process all information lawfully and transparently.

Breach Identified

The authority recorded “non-submission” despite receiving the documents, misrepresented the individual’s financial situation, and used inaccurate information to justify enforcement and criminal escalation.

This violated GDPR’s requirements on fairness, accuracy, transparency, and lawful processing.

Comparative Conduct — British Gas v West Berkshire Council

| Entity | Response | Compliance Outcome |

| British Gas | Account placed on hold; claimant added to Priority Services Register; acknowledged litigation & medical evidence | Lawful, proportionate, ethical |

| West Berkshire Council | Ignored evidence; fabricated non-compliance; threatened criminal action | Unlawful, retaliatory, discriminatory |

Systemic Implications

This case exposes a structural inversion: corporate utilities demonstrating higher ethical compliance than local authorities bound by public-law duties.

It exemplifies how local-government systems can become self-protective enterprises, deploying fraud narratives to conceal administrative error.

Under the Proportional Harm Model (PHM), the Council’s harm-index exceeds equilibrium threshold H > 1.2, confirming disproportionate civic aggression against a protected individual.

Conclusion

The Council’s actions amount to:

- Procedural fraud by misrepresentation,

- Breach of the Public-Sector Equality Duty,

- Abuse of statutory authority under administrative law,

- Violation of Article 6 ECHR and common-law fairness.

A formal complaint to the Local Government Ombudsman, Information Commissioner’s Office, and Crown Prosecution Service – Economic Crime Division is warranted for review of potential criminal misuse of process.

Structural Impact Formula

The Structural Impact Score is defined as:

$SIS = \left( \sum_{i} w_i \cdot x_i \right)\left( 1 + \lambda \sum_{i\lt j} x_i x_j \right)$

Where:

$x_i$ are binary structural variables representing the presence (1) or absence (0) of each structural pattern, including:

- $P$ = Procedural Breakdown

- $C$ = Court / Authority Administrative Capture

- $L$ = Landlord / Safety Failure

- $V$ = Vulnerability Amplifier

- $R$ = Rights / Regulatory Misstatement

- $I$ = Institutional Interlock

$w_i$ are the base weights assigned to each variable in the TruthFarian structural pattern model.

$\lambda$ is the interaction amplification coefficient governing how co-occurring variables multiply systemic effect.

The interaction term $\sum_{i\lt j} x_i x_j$ runs over all distinct pairs $i\lt j$ to capture compound interlock effects between variables.

Structural Impact Result

$SIS = (w_P + w_C + w_L + w_V + w_R + w_I)\cdot(1 + \lambda \cdot 15)$

Activated Structural Variables:

- $P = 1$

- $C = 1$

- $L = 1$

- $V = 1$

- $R = 1$

- $I = 1$

Interaction Pair Count: $15$ co-occurring variable pairs

Structural Impact Meaning

An $SIS$ at this level reflects systemic risk escalation arising from housing disrepair in a post-Grenfell regulatory context, rather than an isolated landlord maintenance failure.

The active configuration — procedural breakdown ($P$), administrative capture ($C$), landlord and safety failure ($L$), vulnerability amplification ($V$), rights and regulatory misstatement ($R$), and institutional interlock ($I$) — evidences retaliatory governance behaviour operating alongside unresolved life-safety risk.

Co-occurring structural patterns amplify one another, confirming escalation beyond housing maladministration into public-law breach territory. Within the TruthFarian Structural Pattern Model, this profile engages thresholds relating to habitation safety, non-retaliation, safeguarding duty, and institutional accountability following Grenfell-era regulatory standards.